RBI forms working group on digital lending

- Posted By

10Pointer

- Categories

Economy

- Published

15th Jan, 2021

-

Context

- The Reserve Bank of India (RBI) has constituted a working group on digital lending including online platforms and mobile apps to study all aspects of digital lending activities in the regulated financial sector as well as by unregulated players.

What is Digital lending?

- Digital lending is the use of online technology to originate and renew loans in order to deliver faster and more efficient decisions.

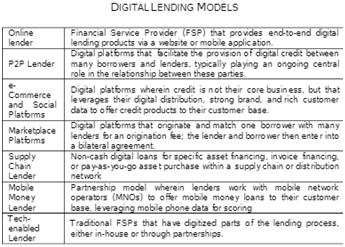

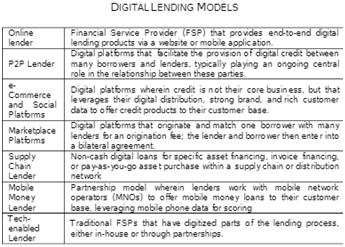

- This mode of lending includes different type of lenders.

Significance of Digital Lending

- It has potential to make access to financial products and services more fair, efficient and inclusive.

- It enhances the financial inclusion.

- It improves the design, pricing and delivery of financial products and services.

- Digitization of the lending process brings a number of powerful benefits for banks, including better decisions, improved customer experience, and significant cost savings.

- It helps to improve productivity, close more loans and increase revenue per loan with cheaper, faster and automated services.

What is the downside risks associated with the Digital Lending?

- Unauthorised digital lending applications

- Poor loan approval and recovery practices

- Week Code of Conduct

- Concern over privacy

What could be done to make a safe digital lending?

- A balanced approach is needed for the regulatory framework and innovation.

- Data security, privacy, confidentiality and consumer protection should be the priority.

- A robust fair practices code should be adopted for digital lending players.