Government to Introduce Single Securities Markets Code

- Posted By

10Pointer

- Categories

Economy

- Published

2nd Feb, 2021

-

Context

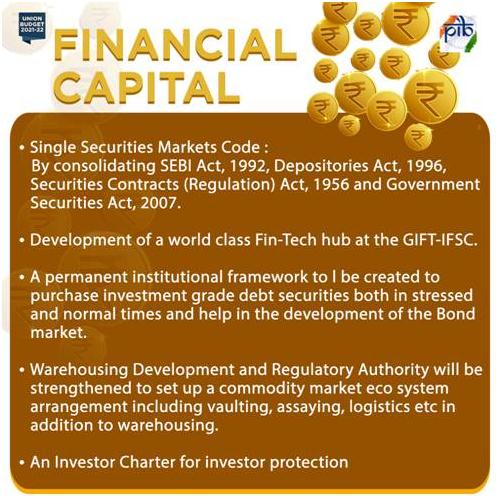

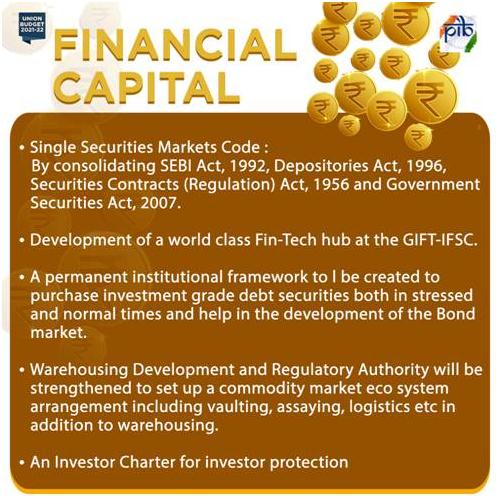

- Government will consolidate the provisions of SEBI Act, 1992, Depositories Act, 1996, Securities Contracts (Regulation) Act, 1956 and Government Securities Act, 2007 into a rationaliszed single Securities Markets Code.

What is the purpose behind it?

- In order to instill confidence amongst the participants in the Corporate Bond Market during times of stress

- To generally enhance secondary market liquidity

- The proposed body would purchase investment grade debt securities both in stressed and normal times and help in the development of the Bond Market.

What are the expected initiatives towards this?

- In the Budget 2018-19, Government had announced its intent to establish a system of regulated gold exchanges in the country.

- For the purpose, SEBI will be notified as the regulator.

- Warehousing Development and Regulatory Authority will be strengthened to set up a commodity market eco system arrangement including vaulting, assaying, logistics, etc in addition to warehousing.

- With an objective to provide protection to the investors, the Finance Minister proposed to introduce an investor charter as a right of all financial investors across all financial products.