FPI inflows highest ever, over Rs 1.4 lakh crore in eight months

- Posted By

10Pointer

- Categories

Economy

- Published

21st Nov, 2020

-

Context

- FPIs have seen a surge in India despite its economy being one of the hardest hit due to the Covid-19 pandemic.

What are FPIs?

- Foreign portfolio investors include both foreign individuals and foreign institutional investors (FIIs).

- Foreign portfolio investment (FPI) involves holding financial assets from a country outside of the investor's own.

- FPI holdings can include stocks, ADRs, GDRs, bonds, mutual funds, and exchange-traded funds.

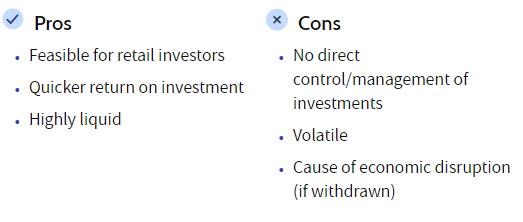

- Along with foreign direct investment (FDI), FPI is one of the common ways for investors to participate in an overseas economy, especially retail investors.

- Unlike FDI, FPI consists of passive ownership; investors have no control over ventures or direct ownership of property or a stake in a company.

What are the reasons behind its surge?

- Inflows started picking up with more liberal unlock guidelines, and a faster and wider reopening of the economy.

- The outcome of the US Presidential elections in the first week of Novemberfuelled FPI inflows into emerging markets and led to a sharp rally in equity markets worldwide.